The end of sustainability investment? Or the catalyst for genuine change?

xUnlocked

With the recent news that The People’s Pension has redrawn its investment strategy to prioritise commitments to sustainability, we consider where the value really lies in the future of sustainability.

In recent years, we have seen many more investors moving to companies that have credible sustainability and climate-transition plans. Towards the end of 2023, approximately $30.3 trillion was being invested globally in sustainable assets, representing a significant portion of total professionally managed assets worldwide, according to the Global Sustainable Investment Alliance (GSIA). And that figure was growing, with some estimating investment could reach $53 trillion this year.

But within the first few weeks of President Donald Trump’s administration, we witnessed the rolling back of US policies on climate action, including the announcement of its withdrawal from the Paris Agreement. Weeks before Trump’s inauguration, no doubt in anticipation of this shift, six of the largest banks in the US exited the UN-convened Net Zero Banking Alliance (NZBA). At the same time, companies including Walmart, Amazon, Ford, McDonald’s, and Meta, all reduced their public emphasis on Diversity, Equity and Inclusivity (DEI) programmes.

So far, so bleak for the future of sustainability. However, not all is as it seems.

Behind the headlines: Sustainability gets real

In recent investment news, The People’s Pension, one of the largest master trust workplace pensions in the UK, announced it was pulling £28 billion ($35 billion) from State Street, in favour of Amundi and Invesco, which demonstrate a stronger commitment to responsible investment. “By selecting Amundi and Invesco, we have chosen to prioritise sustainability, active stewardship and long-term value creation,” said Mark Condron, The People’s Pension Chair of Trustees.

This follows in the wake of The People’s Pension’s annual Task Force on Climate-related Financial Disclosures (TCFD) report, which at the end of 2024 showed that the total carbon emissions within the scheme’s Global Investment Fund had been reduced by 53%, while assets had grown by £8 billion to £30 billion in the same time… Value creation indeed.

Even the most negative headlines conceal a more complex reality. In March, for instance, ESG Today reported that UBS had pushed back its target to achieve net-zero emissions by 10 years to 2035, from 2025. But the bank remains a member of the NZBA, and has confirmed that it is still committed to its financed emissions decarbonisation targets.

It has attributed the shift in its operational net-zero goal to its ‘enlarged corporate real-estate portfolio following the acquisition of the Credit Suisse group’, as well as to the latest definition of the ‘net-zero target’ in the Corporate Sustainability Reporting Directive (CSRD). In its Sustainability Report 2024, UBS also said its assets under management with a net-zero ambition had reached $64.4 billion, up from $35 billion in 2023.

In our recent insight covering the banks departing the NZBA, we also noted that the same banks appeared keen to clarify their continued work towards meeting broader sustainability goals. “We remain committed to reaching net zero and continue to be transparent about our progress,” a spokesperson for Citigroup said. In addition, a spokesperson for Goldman Sachs said the bank was “very focused” on increasingly stringent standards and reporting requirements imposed by regulators, and insisted the bank had “made significant progress … on the firm’s net zero goals”.

Even in terms of the NZBA itself, the withdrawal of US banks is being seen as a potential catalyst for raising the bar on climate commitments, especially as most of the banks currently in the coalition are from Europe. Paddy McCully, Senior Analyst at Reclaim Finance, argued recently that European and other banks now have an opportunity to push the NZBA toward stronger stances against fossil fuel expansion, potentially strengthening the Alliance’s overall impact.

But what about US climate policy?

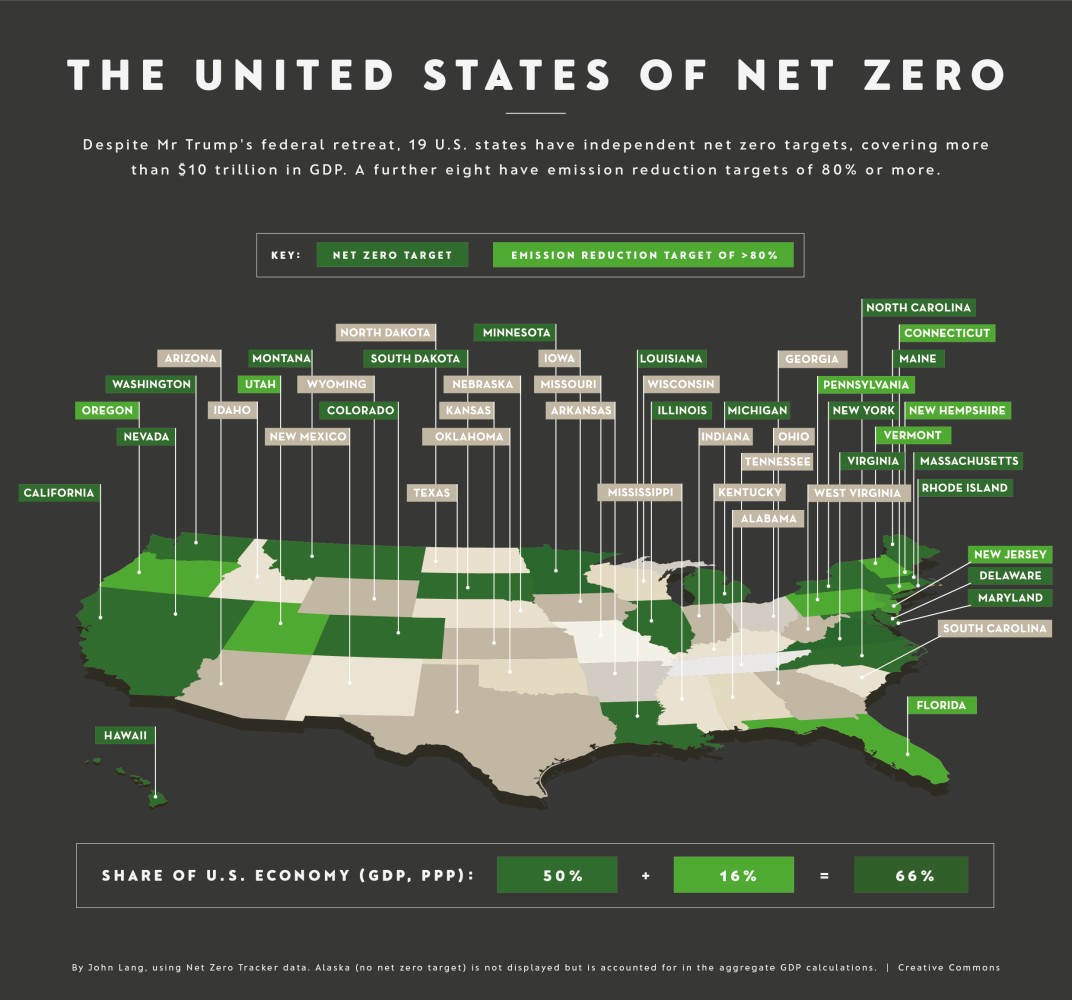

Even in the US, climate action has not been disbanded. While Trump may have revoked Biden’s net-zero targets, research from the Net Zero Tracker shows commitment to climate action continues at state level. Its findings include the following:

- As national net-zero coverage shrinks, subnational entities, including states, cities, and businesses, have increasingly shouldered climate responsibility alongside new international players.

- In the US alone, for example, 50% of states by GDP are independently committed to net zero, while 300 of 626 major US firms have net-zero commitments, representing £7.9 trillion in turnover. The infographic below, compiled by John Lang, Lead at Net Zero Tracker, shows those states with independent net-zero targets, representing more than $10 trillion in GDP.

What does this mean for sustainability strategies?

Sustainability continues to create huge opportunities and value. Indeed, evidence above points to a growing maturity in the sustainability sector, as companies adopt tighter definitions linked to realistic goals, and impose new standards in response to concerns around greenwashing.

What remains clear is this: companies that embed a proper understanding and commitment to sustainability strategy and practice across business divisions now have a real chance to stand out from the pack, impress stakeholders, attract and retain talent, and create investment opportunities long into the future.

Discover more

Interested in finding out more about net-zero targets, and the ways in which their implementation can be tracked?

🎥 In this clip from the Assessing Net Zero Targets video, Natasha Lutz, Data Co-Lead at the Net Zero Tracker, explains how the Net Zero Tracker assesses net zero targets, scrutinising clarity, ambition, emissions scope, and implementation plans.

This full video is now available for free. Watch it now to learn more about how to ensure the efficacy and integrity of net-zero targets, and then sign up for your 7-day free trial to access the whole course, and more, across the Sustainability Unlocked platform.

xUnlocked

Share "The end of sustainability investment? Or the catalyst for genuine change?" on

Latest Insights

Rethinking AI: Unlocking business value, shaping humanity's future

15th August 2025 • xUnlocked

Are knowledge gaps or disparities blocking your sustainability success?

10th June 2025 • Maria Coronado Robles